Medicare Insurance Services

Need Help Navigating Your Medicare Options?

The Big 65 Medicare Insurance Broker

The Big 65

Independent Medicare Insurance Broker

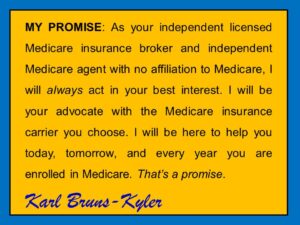

Thank you for visiting The Big 65 website. My name is Karl Bruns-Kyler and I'm an independent licensed Medicare insurance broker and independent insurance agent serving twenty-nine states across the country. I have no affiliation with Medicare.

For over 20 years I've been helping Medicare beneficiaries. I’ve seen many changes in Medicare during these last two decades. However, one thing hasn't changed:

MEDICARE IS COMPLICATED!

My role as your Medicare insurance broker, is to un-complicate Medicare by doing the following:

ONE ... HELP you identify the appropriate Medicare Plan option for you.

TWO ... FIND the lowest cost plan for the appropriate Medicare option for you.

THREE ... PROVIDE you with one-on-one, concierge level service each and every year to make sure your current Medicare Plan is meeting your ongoing healthcare needs.

FOUR ... KEEP you abreast of changes in Medicare and the overall landscape of healthcare for people 65 years of age and older and those younger than 65 on Social Security Disability Insurance (SSDI).

THERE IS NEVER A CHARGE FOR MY SERVICES. (That means your insurance premium is the same whether you work with me or work directly with the insurance company. The benefit you receive is independent expertise from a trusted source. )

Again, thank you for visiting my website. It would be my privilege to help you with Medicare.

Click HERE to schedule a 15 minute no obligation session to discuss your Medicare options.

One more thing ... over the years, my clients have become more than just clients. They have become friends. Every one of them has a fascinating story to share. And I've been fortunate enough to hear many of them. For that, I am grateful.

As a licensed Medicare insurance broker serving communities in twenty-seven states from around the country, Karl Bruns-Kyler is committed to helping Medicare beneficiaries understand their Medicare choices with simplicity and professional expertise.

Karl Bruns-Kyler is an independent licensed Medicare insurance agent (independent Medicare broker) providing Medicare insurance services to Alabama, Arizona, California, Colorado, Connecticut, Florida, Georgia, Idaho, Indiana, Iowa, Kansas, Louisiana, Maryland, Michigan, Minnesota, Missouri, Nevada, New Hampshire, New Jersey, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin.

YES, I would like to have a licensed insurance agent call or email me about Medicare Advantage Plans, Medicare Part D Prescription Drug Plans and/or Medicare Supplement Insurance.

Karl Bruns-Kyler is a licensed Medicare insurance agent and independent Medicare broker in thirty states around the country to help with Medicare insurance. Those states include: AL, AZ, CA, CO, CT, FL, GA, ID, IN, IA, KS, LA, MD, MI, MN, MO, NV, NH, NJ, NY, NC, OH, OK, PA, SC, TN, TX, VA, WA, WI.

Additional states will be added as Medicare insurance needs increase around the country.

We do not offer every plan available in your area. Currently, we represent 10 organizations that offer 50 products in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.