The Big 65 Colorado

Thank you for visiting The Big 65 Colorado website. My name is Karl Bruns-Kyler and I’m an independent Colorado licensed Medicare insurance broker in Highlands Ranch serving Denver’s Front Range with no affiliation to Medicare or the state of Colorado.

I’ve been helping Medicare beneficiaries throughout Colorado and across the country for over 20 years.

One thing has NOT changed these past two decades:

MEDICARE IS COMPLICATED !

As an independent Colorado licensed Medicare insurance broker, my job is to simplify the Medicare process by doing the following:

ONE → HELP identify the appropriate Medicare coverage for you with the lowest costs.

TWO → PROVIDE you with one-on-one, personalized service, every year to make sure your current Medicare coverage is meeting your healthcare needs.

THREE → KEEP you informed of changes to Medicare and the overall landscape of healthcare for people 65 years of age and older and those younger than 65 on Social Security Disability Insurance (SSDI).

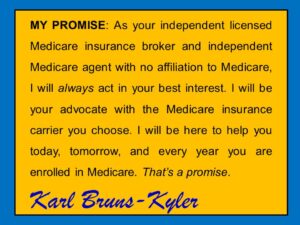

THERE IS NEVER A CHARGE FOR MY SERVICES. (Free means free because your insurance premium is the same whether you work with me or directly with the insurance company. The benefit you receive is independent expertise from The Big 65.)

Again, thank you for visiting my website. It would be my privilege to help you with your Medicare coverage.

Click HERE to schedule a 15 minute no obligation session to discuss your Medicare options in Colorado.

YES, I would like to have a Colorado licensed insurance agent call or email me about Medicare Advantage Plans, Medicare Part D Prescription Drug Plans and/or Medicare Supplement Insurance.

Karl Bruns-Kyler is based in Highlands Ranch, Colorado. Karl is a Colorado Medicare insurance broker providing Medicare insurance services to the Front Range communities of Colorado, including Denver, Highlands Ranch, Boulder, Centennial, Colorado Springs, Evergreen, Littleton, Lone Tree, Greenwood Village, and Monument. Karl also works with Medicare beneficiaries in Buena Vista, Breckenridge, Broomfield, Fort Collins, Greeley, Manitou Springs, Wellington, and across the state of Colorado.

Karl Bruns-Kyler is a licensed Medicare insurance broker and independent agent based in Highlands Ranch, Colorado. Karl is also licensed in the following states to help with Medicare insurance:

AL, AZ, CA, CO, CT, FL, GA, ID, IN, IA, KS, KY, LA, MD, MI, MN, MO, NV,

NH, NJ, NY, NC, OH, OK, PA, SC, TN, TX, VA, WA, WI.

Additional states will be added as Medicare insurance needs increase across the country.