Greetings and may this note find you in great health with your Medicare coverage working properly. Today, I want to discuss changes to your Medicare Prescription Drug Plans for 2024. But first …

If you’re having problems, reach out to Gray or book a time on my calendar if it’s complicated.

Don’t you love the smile on this guy’s face? He’s enjoying the day tooling around the old town sharing his city with travelers in this classic car.

That’s the way I’d like to feel every day.

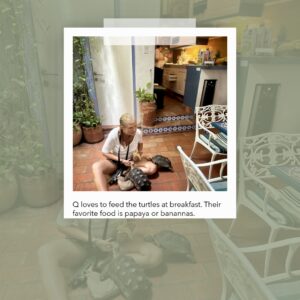

My reality is a little closer to this old tortoise who sleeps behind the planters in this old hotel.

Every morning, getting up and out is a little harder. I’m a little achier and often a little grumpier, but, a good cup of coffee makes all the difference in the world.

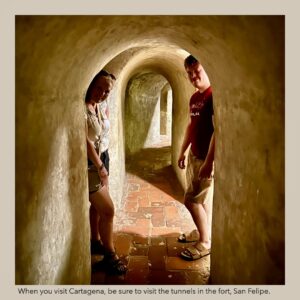

Once we get up and out, there are adventures waiting, especially when Quantz twists my arm and gets me to do something I’d enjoy but wouldn’t do on my own.

If it weren’t for her, I’d work more and enjoy less. Traveling with Q pushes my comfort zone.

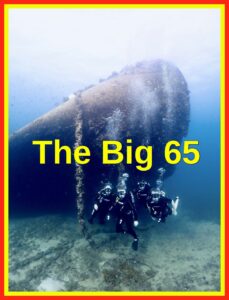

This is an old German freighter off the coast of Aruba. Instead of letting it fall into Allied hands in 1942, the captain chose to sink her himself by flooding the boiler room and causing the engine to explode. I’m glad I wasn’t on board.

Our daughter Sus had to return to her home in Colorado because she had a burst pipe. As you can tell, Plato was happy to see her but he’s still mad at us for leaving him at home with her boyfriend.

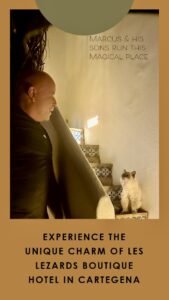

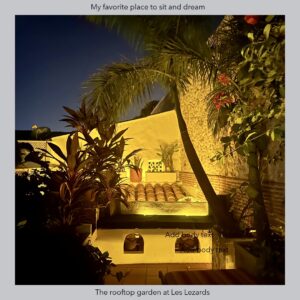

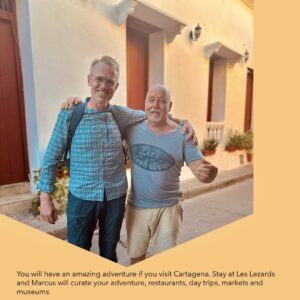

Now Quantz, our Air Force son Nicholas, and I have moved on to explore Colombia.

Thanks to Tim in Firestone, Colorado for sharing an interesting article from the Wall Street Journal about drug trends for Medicare. Here’s the gist:

In 2024, Medicare Part D plans will have a ceiling of $8,000 for how much they and consumers (combined) will pay out of pocket.

Changes brought about by the 2022 Inflation Reduction Act mean that people on Part D plans will pay no more than roughly $3,300 on drugs annually (subject to variation based on brand or generic medications).

In 2025, the cap will change to a flat $2,000.

The 5% coinsurance that patients had to pay after reaching the “catastrophic” spending threshold has been eliminated. This change is expected to offer significant savings to approximately 1.5 million people.

The cap on drug costs will force insurers and drugmakers to cover a larger part of the cost.

Potential downsides for Medicare patients include higher premiums and more complicated paperwork.

The changes represent a significant makeover to the Part D prescription-drug benefit.

Cancer drugs in pill form can be costly for people on Part D plans, and these changes are expected to provide substantial savings for patients with expensive medications.

Despite all the good news, drug costs seems to be one of the biggest frustrations everyone has.

Remember the following strategies when filling a prescription:

Often, physicians will prescribe a brand name medication without taking into consideration a client’s financial situation. Check with the doctor’s office to see if they can provide you with a sample before you shell out your own money.

If you are a prescribed a brand name drug, check with your pharmacist and find out if there is a generic alternative.

A single medication is always easier but sometimes, a combination of drugs can be used successfully and perhaps keep down your costs. Every situation is different so do your homework.

Before filling the prescription through your drug plan, ask the pharmacist if they have a cash price that is lower than your copay.

If you get into the catastrophic phase every year (which means the total cost of your drugs {paid by you and the drug plan, $8,000 for 2024} then you may want to run all of your drugs through plan but…

If you barely reach the donut hole each year ($5,030 paid by you and the drug plan) or never reach the donut hole, paying the cash price or using a third party tool like GoodRx, Amazon, or Cost Plus Drugs might save you some serious coin.

Life continues to be filled with a million moving pieces but if you take thirty minutes and make a few calls and check a few websites, it might really save you some money.

Please know that even though we are traveling, I have slots open every week if you need me.

Keep squeezing the juice out of life and look for ways to help others!

Medicare questions or problems?

Book a time on my calendar or email Gray, Gray@theBig65.com.

If family or friends need help… referrals are the lifeblood of my business.

Let us know what’s going on and please send pictures :).

Karl Bruns-Kyler

(877) 850-0211

Book a time on my calendar here

Happy with my Service? Click Here to Leave a Review.

Karl Bruns-Kyler is a Medicare insurance broker and independent Medicare agent licensed to help Medicare recipients in thirty states around the country, including:

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Florida

Georgia

Idaho

Indiana

Iowa

Kansas

Louisiana

Maryland

Michigan

Minnesota

Missouri

Nevada

New Hampshire

New Jersey

New York

North Carolina

Ohio

Oklahoma

Pennsylvania

South Carolina

Tennessee

Texas

Virginia

Washington

Wisconsin

The Big 65 Medicare Insurance Services does not offer every plan available in your area. Currently, we represent 10 organizations that offer 50 products in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.