Greetings and may this blog post find you in great health with your Medicare coverage working properly.

If you changed plans in the fall, you should have received your new ID cards by now.

If you haven’t, or if you’re having a carrier issue (and you’ve already spoken to the carrier), reach out to Gray and he’ll get you squared away.

In talking with clients this week, I’m hearing a lot about issues with billing.

According to this article, up to 80% of all medical bills have at least one error.

Client Stan tells me he’s pulled out most of his hair trying to get a shingles vaccine bill properly coded and submitted. He received incorrect information from the doctor and from Medicare ☹. Stan is a retired engineer so if someone as logical as he is can’t get the right answer, it sure is frustrating.

I wish I could tell you there was a single step you could take to avoid billing issues, but complicated problems are never solved that easily.

However, if you have a Medicare Supplement, Plan G, your only out-of-pocket for Medicare approved services (excluding drugs, dental, and vision) is $240.

If you have a Medicare Advantage plan, the summary of benefits should you provide you with exact costs for deductibles, copays and the maximum out of pocket each year.

Nevertheless, here are some suggestions to help you avoid over paying:

Check Your Information:

- Billing errors can happen due to small mistakes on your insurance claim form.

- Even a single missing digit in your insurance ID or a misspelled name can lead to denied claims and premature billing.

- Verify that your insurance details on the bill are accurate and have been processed by your insurance company.

Compare to EOB:

- After your health insurance processes claims, you’ll receive an Explanation of Benefits (EOB).

- Compare your medical bill to the EOB to ensure the amount on the invoice matches what your insurance says you owe.

Beware of Aggressive Billing:

- Some providers may send bills while your insurance is still processing your claim.

- Don’t pay these bills without checking with your insurance company.

- Look for phrases like “Due Now,” “Estimated Amount Due,” or “Amount You May Owe.”

Request an Itemized Statement:

- Medical bills often lack a detailed breakdown of charges.

- Ask for an itemized statement to ensure you’re only paying for services and items you received.

Check Billing Codes:

- Each medical procedure has a billing code (HCPS/CPT), and there are diagnosis codes (ICD-10) for medical conditions.

- Review these codes to ensure they’re correct.

- Mistakes in codes can lead to claim denials or unjustified procedures.

- Research codes independently and take action if there’s an issue.

Negotiate a Reduction:

- If your bill is more than you can afford, negotiate with the provider.

- Find resources online to determine fair service costs.

- Make your financial constraints known and ask for a discount or a payment plan.

- Paying a lump sum may increase your chances of getting a discount.

- Ask for zero interest on a payment plan.

Act Quickly:

- Address your medical bills promptly to avoid collection agency involvement.

- Hospitals must wait six months before reporting to credit bureaus, but late reporting can affect your credit for years.

- Taking quick action can prevent future financial issues like higher interest rates or difficulty securing loans.

The bottom line: be slow and extra careful BEFORE you remit any payment to healthcare providers and call the insurance company for help as well. This process will not eliminate the number of mistakes, but hopefully it will reduce them.

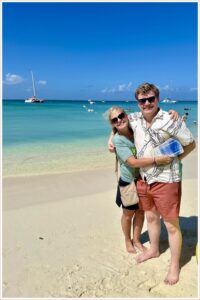

In case you couldn’t tell, the Bruns-Kyler family is celebrating their first vacation as a family together in almost three years. We finally got our Air Force son together with the rest of the family at the same time. We are giving thanks for warm weather and this time together in Aruba. Can you tell Q was happy to see our son?

Remember, life is short. Don’t take anything or anyone for granted!

Keep squeezing the juice out of life and look for ways to help others!

Medicare questions or problems?

Book a time on my calendar or email Gray, Gray@theBig65.com.

If family or friends need help… referrals are the lifeblood of my business.

Let us know what’s going on and please send pictures :).

Karl Bruns-Kyler

(877) 850-0211

Book a time on my calendar here

Happy with my Service? Click Here to Leave a Review.

Karl Bruns-Kyler is a Medicare insurance broker and independent Medicare agent licensed to help Medicare recipients in thirty states around the country, including:

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Florida

Georgia

Idaho

Indiana

Iowa

Kansas

Louisiana

Maryland

Michigan

Minnesota

Missouri

Nevada

New Hampshire

New Jersey

New York

North Carolina

Ohio

Oklahoma

Pennsylvania

South Carolina

Tennessee

Texas

Virginia

Washington

Wisconsin

The Big 65 Medicare Insurance Services does not offer every plan available in your area. Currently, we represent 10 organizations that offer 50 products in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.