Hello and may this blog find you in great health 💪 with your Medicare insurance coverage working properly.

For Medicare questions, quotes, or quandaries, email Gray@TheBig65.com or book a time on my calendar and we’ll get it sorted.

Lynne sent this picture of Mike in North Carolina to confirm they received the last of our honey. These two have been pulling an RV for years and when Mike and I aren’t talking about college football (or Medicare), he’s telling me about their adventures and what’s up with friends.

It’s a privilege to interact with clients like Mike and Lynne who really are squeezing the juice out of life. I don’t mean to suggest their lives are perfect, yet they’ve found a way to enjoy retirement together. My perception is they are still rooting for each other, even after many years.

We know that “getting old ain’t for sissies.” This blog is about the challenges all couples face in not driving each other crazy. Are you ready for this journey through the “Heart of Darkness😄?”

For years, most of us dream of crossing the retirement line and entering the promised land and having control of our time. But after we get what we think we want, things change, right?

When the retirement honeymoon ends, the joy of time freedom can fade and the new reality of life sets in.

According to this article, many couples struggle to find relationship equilibrium in retirement. Divorces are rising as boomers seek self actualization and re-evaluate our lives and our marriages.

This isn’t always an easy transition and it sometimes requires purposeful navigation through new and surprisingly uncertain waters.

Retirement can cause an identity crisis for those who were very involved in their careers. Without the daily distractions of work, deeper marital problems can become more obvious.

Couples often face financial worries, with different attitudes towards spending and saving becoming more pronounced.

Many couples then struggle with the changed dynamics. Getting used to spending much more time together in the same space requires adjustment. Are you hiding the sharp objects 😄?

These new paradigms can strain marriages unless couples actively work on adapting and supporting each other’s new roles and interests. So there is hope!

Here are some ideas:

• Communicate Openly: Talk honestly about feelings and expectations.

• Enjoy Activities Together: Share hobbies and interests to stay connected.

• Maintain Independence: Support each other’s need for personal space and solo activities. (Guess who went to a Long Term Care conference without Q?)

Other steps to consider:

• Adjust Roles: Discuss and adopt new household roles and responsibilities together.

• Plan Finances Together: Manage money jointly to avoid stress.

• Provide Emotional Support: Be there for each other during emotional ups and downs.

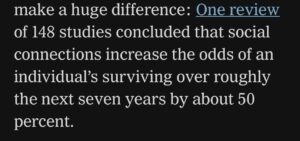

• Stay Socially Active: Keep up with friends and make new ones.

• Consider Counseling: Seek professional help if needed to resolve conflicts.

• Stay Active: Engage in physical activities together for better health.

• Set New Goals: Plan for future projects and dreams together.

Small adjustments over a long period of time lead to amazing results. Nothing happens overnight. Just like Bobby’s eggplants, good things take time, right?

I’ve heard from several clients that they’ve found a bit of help with their medication costs after emailing Cori at The Canadian Medstore in Florida.

If your drugs are getting pricey, do click on this link to send her an email. Add your prescription name, dosage, and how many you take daily and they may be able to help. For some, it’s been no help, for others, it has saved them some money.

After the Long Term Care insurance conference, I had the pleasure of visiting Marcos, a life long friend that makes me better. It’s always good to see people you love and stay connected.

Equally fun, I spent time with our niece Lisle in Chicago. It’s so fun to see the young uns growing up. Who do you need to connect with next? Please don’t wait, the clock is ticking.

Keep squeezing the juice out of life and look for ways to help others!

If family or friends need help… referrals are the lifeblood of my business.

If you know someone who might like to receive The Big 65 newsletter, forward this link.

Medicare questions or problems?

Book a time on my calendar or email Gray, Gray@theBig65.com.

Let us know what’s going on and please send pictures :).

Karl Bruns-Kyler

(877) 850-0211

Book a time on my calendar here

Happy with my Service? Click Here to Leave a Review.

Karl Bruns-Kyler is a Medicare insurance broker and independent Medicare agent licensed to help Medicare recipients in thirty states around the country, including:

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Florida

Georgia

Idaho

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maryland

Michigan

Minnesota

Missouri

Nevada

New Hampshire

New Jersey

New York

North Carolina

Ohio

Oklahoma

Pennsylvania

South Carolina

Tennessee

Texas

Virginia

Washington

Wisconsin

The Big 65 Medicare Insurance Services does not offer every plan available in your area. Currently, we represent 10 organizations that offer 50 products in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.