Hello and may this note find you in great health with your Medicare insurance coverage working properly.

Any time you have Medicare questions, need quotes, or have quandaries, email Gray@TheBig65.com or book a time on my calendar and we’ll get it sorted.

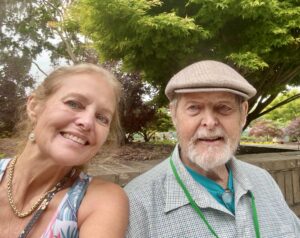

I usually work late at night with clients when we are overseas, so I was a little groggy when we took this early morning tour of a Roman arena in Pula, Croatia.

Remember how Wiley Coyote could walk off a cliff into thin air in the Roadrunner cartoons, beep beep? It never ended well, did it?

Emergencies can strike unexpectedly, and when they do, seconds count.

First responders must gather critical information swiftly in chaotic situations.

Here’s a crucial tip paramedics shared in an article that could potentially save your life: make sure your medical information is easily accessible, at home and on the road!

Seconds Count: Why Preparation Matters

Time spent searching for medical details like allergies, meds, and existing conditions could mean the difference between life and death.

During emergencies like heart attacks or strokes, swift action can prevent irreversible brain damage.

Step 1: Document Your Details. Start by writing down essential information on a piece of paper:

- Your name and date of birth

- Medical history and existing conditions

- Emergency contact number

- Current meds, dosages, and any allergies

Include details like your blood type just in case you need a blood transfusion.

Step 2: Make It Accessible. Once you’ve compiled this info:

Wallet: Keep a smaller version in your wallet for immediate access.

Home: Place a larger copy on the fridge or near your front door, where paramedics are likely to look if you’re not able to communicate.

This simple step ensures that paramedics can quickly retrieve vital info without delay, potentially saving valuable time in critical situations.

Step 3: Use Technology to Your Advantage. In addition to physical copies, consider setting up your medical ID on your smartphone:

iPhone or Android: Enter your health details in the Medical ID section, accessible even without unlocking your phone. This feature can provide paramedics with crucial information at their fingertips.

We watched Euro Cup finals in the square, Spain vs. England. Ian was so happy when England tied the score, I thought he was going to have a heart attack! Sadly for him, Spain won!

Additional Tips for Emergency Preparedness. While having your medical information handy, paramedics also emphasize a few other practical tips:

Unlock Doors: If you’ve called 911, ensure your doors are unlocked to allow paramedics quick access.

Secure Pets: Keep pets safely contained during emergencies to avoid additional hazards.

Prepping for emergencies is a proactive step that could save your life. In emergencies, every second truly counts.

Whether you’re on the road or at home, making sure your medical information is readily available could be the most important gift you give your loved ones.

We don’t want them to have to ring the church bells for you!

Let me know if this tip was helpful. The first ten clients to send a picture of themselves and their medical info attached to the fridge will get a Starbucks card☕!

Keep squeezing the juice out of life and look for ways to help others!

If family or friends need help… referrals are the lifeblood of my business.

If you know someone who might like to receive The Big 65 newsletter, forward this link.

Medicare questions or problems?

Book a time on my calendar or email Gray, Gray@theBig65.com.

Let us know what’s going on and please send pictures :).

Karl Bruns-Kyler

(877) 850-0211

Book a time on my calendar here

Happy with my Service? Click Here to Leave a Review.

Karl Bruns-Kyler is a Medicare insurance broker and independent Medicare agent licensed to help Medicare recipients in thirty states around the country, including:

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Florida

Georgia

Idaho

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maryland

Michigan

Minnesota

Missouri

Nevada

New Hampshire

New Jersey

New York

North Carolina

Ohio

Oklahoma

Pennsylvania

South Carolina

Tennessee

Texas

Virginia

Washington

Wisconsin

The Big 65 Medicare Insurance Services does not offer every plan available in your area. Currently, we represent 10 organizations that offer 50 products in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.