May this note find you in great health with your Medicare coverage working properly.

Are you getting ready for the holidays?

The Annual Election Period is over 🎉🙏🎉! It was so much fun catching up with so many of you from all over the country. Most people kept their plans but some made changes.

If we didn’t speak and you aren’t happy with your Advantage coverage, don’t worry.

You have until the end of March to make one change if you need to. Most people don’t need to do anything, but if you’re unsure, book a time in January to make sure.

If Plato looks warn out above, that’s because he played hard all day. Say hello to “Suki,” our newest house guest and Plato’s new pal.

Suki and his boss Max arrived this morning to live with us for a while and we immediately drafted them to help us cut down a Christmas tree up in the Rockies.

After ten weeks of ten hour days (including most weekends), it was a pleasure to get out of the house and up into the snow in the Arapahoe National Forest.

Plato was even gladder than me to be out of the house and doing something new with Suki.

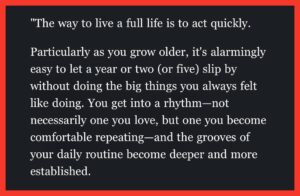

I was so tempted to spend the day vegging, but I followed James Clear’s advice and we had a great afternoon hunting the perfect tree (plus the permit to cut a tree was only $20).

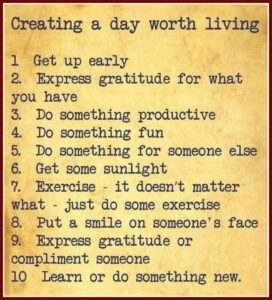

Every time we do something new, our brains make new connections and it strengthens our bodies, our minds, and our souls.

Listen to this three minute Ted Talk on how a group of nuns avoided the pitfalls of dementia just by doing new things.

We cut down this 18 footer and carried her out of the forest through deep snow, strapped her on top of the car, and drove down the mountain. It was exhilarating to do something new.

On the way down I caught up with our daughter Sus and she sent pics from the Ugly Sweater Party at work. I guess that’s way computer coders like to have fun.

Before heading up the mountain, I spent an hour on the phone with Nathan Jenkins, a Physician’s Assistant and a retired Navy Veteran. He now works for a company that does in-home health assessments and I learned so many interesting things about the state of medical care in America.

His best piece of advice: every time you go to the doctor, throw ALL OF YOUR MEDICATIONS in a large plastic bag and put them on the table in front of the doctor and have them confirm that you still need to be taking each medicine.

Nathan said most doctors are great at beginning the healing process but they are not always great at formulating an end game to treatment. Many patients continue to take a medicine to treat a specific condition (like situational depression) long after the condition has subsided. Be sure to review your prescriptions with EVERY DOCTOR you see.

By the way, if you take a statin, watch this video a cardiologist posted on the pros and the cons of taking this medication.

Q had a birthday in early December – 29, again 😶🤫. We celebrated with great friends that I plan to see more often because life is incredibly short and we never know when it will end.

Two weeks ago, Frank and Brigitte were driving to Costco, a regular Saturday morning. As Frank looked ahead, he suddenly saw a car out of control heading straight at them at break neck speed. “Gina, hold on, we’re gonna roll.” To avoid the head on collision, he swerved and the car flipped down the embankment.

When the paramedics came with jaws of life, they expected to find two lifeless bodies. No one could survive such a devastating crash.

Miraculously, Frank and Brigette were standing beside their 1950 Oldsmobile Ricket 88 completely unharmed.

The officer said if it hadn’t been made of solid steel (and if the both hadn’t been in such excellent physical shape), they would have gone through the windshield and been nothing more than a statistic.

What’s even more impressive? One year ago, I visited Frank in his home and he was bedridden, slowly recovering from an extremely difficult surgery. This is one of the most amazing couples I’ve ever met. Their love for each other, their work ethic, and their faith make them a living miracle, and a treasure.

Never give up, never surrender. As Winnie the Pooh said famously:

“You’re braver than you believe, stronger than you seem, and smarter than you think.”

Keep squeezing the juice out of life and look for ways to help others!

Medicare questions or problems?

Book a time on my calendar or email Gray, Gray@theBig65.com.

If family or friends need help… referrals are the lifeblood of my business.

Let us know what’s going on and please send pictures :).

Karl Bruns-Kyler

(877) 850-0211

Book a time on my calendar here

Happy with my Service? Click Here to Leave a Review.

Karl Bruns-Kyler is a Medicare insurance broker and independent Medicare agent licensed to help Medicare recipients in thirty states around the country, including:

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Florida

Georgia

Idaho

Indiana

Iowa

Kansas

Louisiana

Maryland

Michigan

Minnesota

Missouri

Nevada

New Hampshire

New Jersey

New York

North Carolina

Ohio

Oklahoma

Pennsylvania

South Carolina

Tennessee

Texas

Virginia

Washington

Wisconsin

The Big 65 Medicare Insurance Services does not offer every plan available in your area. Currently, we represent 10 organizations that offer 50 products in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.